Announcements, Azure Arc, Azure Stack Edge, Hybrid + Multicloud

Stratégies hybrides et multicloud pour les prestataires de services financiers

Posted on

8 min read

Besoin de stratégies hybrides et multicloud pour les services financiers

Le secteur des services financiers est un espace dynamique qui ne cesse de tester et explorer de nouveaux cas d’utilisation des technologies de l’information. Nombre de ses membres doivent relever d’immenses défis, qu’il s’agisse des pressions poussant à promouvoir l’innovation continue dans un paysage caractérisé par l’arrivée de nouveaux venus dans le cloud, de répondre à des pics inattendus de demande ou d’étendre des services à de nouvelles régions, tout en gérant les risques et en luttant contre la criminalité financière.

En même temps, les réglementations financières évoluent sans cesse. Face à la pandémie actuelle, nous avons vu nos clients accélérer leur adoption des nouvelles technologies. Ce fut, par exemple, le cas des services cloud publics désireux de suivre l’évolution des réglementations et des demandes du secteur. Parallèlement à l’adoption croissante du cloud, nous avons vu émerger un souci croissant des réglementations en lien avec le risque de concentration (voir notre récent livre blanc à ce sujet), qui ont donné lieu à de nouvelles recommandations à l’adresse des clients, visant à renforcer leur résilience opérationnelle globale, à prévenir les risques de dépendance à l’égard de fournisseurs et d’exiger des plans de sortie efficaces.

Pour compliquer encore les choses, de nombreuses sociétés de services financiers administrent des portefeuilles de services qui comprennent des applications héritées utilisées depuis de nombreuses années. Souvent, ces applications ne peuvent pas épauler l’implémentation de nouvelles fonctionnalités permettant de prendre en charge des applications mobiles, la veille économique et d’autres capacités de service nouvelles, et souffrent de lacunes qui nuisent à leur résilience, comme le fait d’avoir des processus manuels et obsolètes en matière de gouvernance, de mises à jour et de sécurité. Ces applications héritées dépendent également fortement des fournisseurs, car elles manquent d’interopérabilité et de portabilité modernes. En outre, l’approche sommaire consistant à tirer parti de technologies héritées comme moyens de protection contre la criminalité financière est une stratégie non durable dont l’efficacité diminue. En effet, les grandes banques dépensent plus d’un milliard de dollars par an au maintien d’infrastructures héritées et constatent une augmentation des taux de faux positifs à mesure que la criminalité financière gagne en sophistication.

Pour répondre aux demandes de modernisation, de concurrence et de conformité, les prestataires de services financiers se sont tournés vers des stratégies de cloud public, de cloud hybride et multicloud. Un modèle hybride permet d’étendre des applications existantes, à l’origine locales, en les connectant au cloud public. Cette infrastructure libère les avantages du cloud public, tels que la mise à l’échelle, la vitesse et le calcul élastique, sans obliger les organisations à réarchitecturer certaines applications. Cette approche offre aux organisations la possibilité de choisir les parties d’une application qui doivent résider dans un centre de données existant plutôt que dans le cloud public, et d’ainsi adopter une approche cohérente et flexible de l’élaboration d’une stratégie de modernisation.

Des stratégies de cloud hybride réussies offrent notamment les avantages suivants :

- Une approche unifiée et cohérente pour la gestion de l’infrastructure : gérez, sécurisez et gérez les ressources informatiques en local, multicloud et en périphérie, offrant une expérience cohérente entre les emplacements.

- Étendre la portée géographique et ouvrir de nouveaux marchés : répondre à la demande mondiale croissante et s’étendre sur de nouveaux marchés en étendant les capacités des centres de données à de nouveaux emplacements, tout en répondant aux exigences de localisation des données des marchés locaux

- Gestion de la sécurité et de l’augmentation de la conformité réglementaire : les stratégies hybrides et multiclouds sont idéales pour les stratégies strictement locales en raison des avantages cloud liés à la sécurité, à la disponibilité, à la résilience, à la protection des données et à la portabilité des données. Ces stratégies sont souvent évoquées comme un moyen de prédilection pour réduire les risques et relever les défis liés à la conformité réglementaire.

- Élasticité croissante : les clients peuvent répondre avec agilité aux augmentations de la demande ou de la transaction en approvisionnant et en déprovisionnant la capacité en fonction des besoins. Une stratégie hybride permet aux organisations d’étendre en toute transparence leur capacité au-delà de leur centre de données dans le cadre de scénarios nécessitant une grande puissance de calcul, tels que les calculs de risques et la modélisation de risques complexes, sans surcharger les serveurs ou ralentir les interactions avec les clients.

- Réduction des dépenses CapEx : le cloud rend nécessaire une telle dépense de capital importante pour la gestion de l’infrastructure locale inutile. La capacité élastique dans des scénarios hybrides permet aux entreprises d’éviter les coûts d’une capacité numérique inutilisée, en ne payant que pour les ressources effectivement utilisées.

- Accélérer le marché : une stratégie hybride fournit un pont qui connecte les données locales à de nouvelles fonctionnalités basées sur le cloud dans l’intelligence artificielle et l’analytique avancée, ce qui permet aux clients de moderniser leurs services et de déverrouiller l’innovation. Grâce à des environnements virtualisés, ils peuvent accélérer les cycles de test et d’évaluation et activer le déploiement en toute transparence dans différents emplacements.

Une stratégie multicloud permet aux clients de tirer parti de services qui s’étendent sur différentes plateformes cloud, ce qui leur permet de sélectionner les services les plus adaptés aux charges de travail ou applications qu’ils gèrent.

Les avantages couramment évoqués d’une stratégie multicloud sont les suivants :

- Flexibilité : Les clients souhaitent avoir la flexibilité nécessaire pour optimiser leurs architectures en tirant parti des services cloud les mieux adaptés à leurs besoins spécifiques, notamment la flexibilité de sélectionner des services en fonction des fonctionnalités ou des coûts.

- Évitez le verrouillage du fournisseur : les clients ont souvent besoin d’un état courant, les clients cherchent souvent à concevoir des déploiements multiclouds pour obtenir une flexibilité à court terme et une agilité à long terme en concevant des systèmes sur plusieurs clouds.

Périphérie Microsoft hybride et multicloud pour les prestataires de services financiers

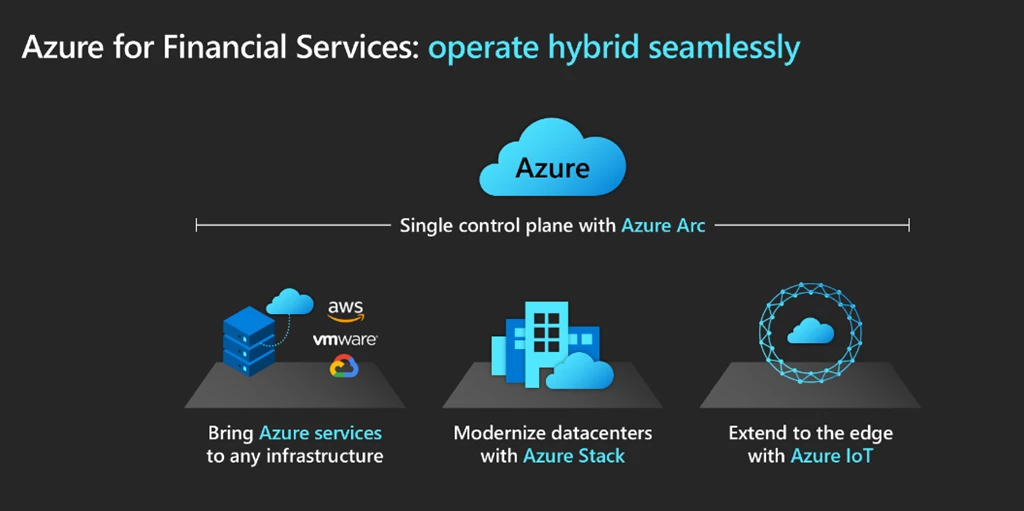

Les fonctionnalités hybrides d’Azure permettent de surmonter de manière unique certains des principaux obstacles auxquels sont confrontés les clients en lien avec les stratégies hybrides et multicloud. La gestion de plusieurs multiples est une entreprise intrinsèquement complexe et délicate pour les entreprises, confrontées à un volume de données en expansion s’étendant sur divers environnements locaux, cloud et périphériques. Optimiser la productivité sans sacrifier la sécurité et la conformité peut sembler être une tâche colossale. Azure fournit un environnement transparent pour le développement, le déploiement et la gestion des données et des applications sur l’ensemble des sites distribués.

Premièrement, Azure prend en charge de manière unique l’éventail complet des fonctionnalités hybrides (DevOps, identité, sécurité, gestion et données). Étant donné que les parcs informatiques des clients incluent bien plus que des conteneurs, bon nombre des avantages de notre cloud sont également disponibles pour les charges de travail basées sur des serveurs. Azure permet aux clients de gérer des serveurs Windows et Linux pour l’ensemble de leurs données, et les clients peuvent également gérer l’authentification des utilisateurs et les accès avec des services d’identité hybrides. Le portefeuille de produits Azure Stack étend les services et fonctionnalités d’Azure à l’environnement de votre choix, du centre de données aux sites périphériques, en passant par les bureaux à distance et les environnements déconnectés. Les clients peuvent exécuter des modèles d’apprentissage automatique en périphérie afin d’obtenir des résultats rapides avant l’envoi de données au cloud. En outre, avec des fonctionnalités telles qu’un Azure Stack Hub, notre portefeuille permet aux organisations d’opérer dans des environnements hors connexion qui empêchent l’envoi de données au cloud public, en particulier lorsque la conformité réglementaire l’exige.

Deuxièmement, Azure simplifie l’expérience de gestion d’un ensemble de données complexe en adoptant une approche unifiée et cohérente de la gestion et de la surveillance de ses environnements hybrides ou multicloud. Des fonctionnalités telles qu’Azure Arc permettent de gérer les données avec un seul plan de gestion, incluant la possibilité de surveiller des clouds non Microsoft. Les clients peuvent également adopter une approche simplifiée similaire pour gérer la sécurité de leurs ressources avec des services tels qu’Azure Sentinel, qui fournit une détection cohérente des menaces et une vue analytique de la sécurité des appareils locaux, cloud et périphériques. La combinaison de services tels qu’Azure Security Center, Azure Policy et Azure Advisor, permet également aux clients de concevoir, déployer et superviser la sécurité et la conformité de leurs déploiements dans leurs environnements hybrides et multicloud.

Le leadership d’Azure en matière d’offres hybrides et multicloud repose également sur nos nombreuses collaborations avec des partenaires fournisseurs de matériel (OEM) avec lesquels nous avons collaboré et conçu des solutions pour fournir une gamme bien définie d’appareils ad hoc. Les solutions de partenaires ont été conçues dans le but de renforcer la résilience et d’étendre la portée des centres de données virtuels. Par exemple, avec la nouvelle offre robuste Azure Stack Edge, nous fournissons des fonctionnalités de cloud dans les environnements les plus rudes, en prenant en charge des scénarios de réponse d’urgence, humanitaires ou tactiques.

L’engagement d’Azure envers les clients des services financiers découle du travail de pointe accompli par Microsoft avec des régulateurs du monde entier. Nos clients exigent de leurs partenaires du cloud qu’ils soutiennent la transparence, le droit réglementaire à l’audit et l’autodéclaration. À cette fin, nous avons mis à la disposition de nos clients un programme dédié et complet en lien avec la conformité des services financiers, et nous les aidons à gérer leur conformité en leur permettant de faire des choix concernant la localisation des données, la transparence et la notification des sous-traitants, en prenant des engagements en matière de planification de sortie (voir notre récent blog ici), ainsi qu’en fournissant des outils d’évaluation des risques.

Pleins feux sur les clients

Nous avons déjà vu bon nombre de nos clients du secteur des services financiers commencer à réaliser les avantages des stratégies hybrides et multicloud. Une récente étude, Total Economic Impact, conduite par Forrester concernant l’impact du passage des solutions locales à Azure IaaS (y compris à des environnements hybrides), sur une période de trois ans, révèle que les organisations concernées ont économisé quelque 90 % des coûts d’infrastructure locale (évalués à plus de 7 millions de dollars), ainsi que des coûts de main-d’œuvre associés. Les organisations ont pu réaffecter leur personnel informatique à des initiatives de plus haut niveau, notamment à des projets d’expansion sur de nouveaux marchés, entraînant de nouveaux flux de revenus.

Un exemple de société ayant adopté une approche hybride est celui de Banco de Crédito e Inversiones (BCI). Leur portefeuille couvrait 20 millions de transactions par mois et nécessitait une approche hybride afin de maintenir les applications et les ressources sur place pour des raisons de réglementation et de performance. Azure Stack Hub leur a permis d’améliorer les performances et la fiabilité de leurs systèmes, et même de déployer rapidement de nouveaux produits. Ils ont pu passer d’une gestion informatique externalisée à une gestion interne.

« Nous avons trouvé la plateforme Azure très fiable et stable, et elle s’améliore à chaque version. En fait, nous disposons de statistiques qui montrent que, lorsque nous avons activé Azure Stack Hub, la satisfaction des clients a augmenté. C’est très clair. Nous offrons une meilleure expérience à nos clients grâce à la fiabilité et aux performances d’Azure Stack Hub et aux nouvelles fonctionnalités que notre équipe y ajoute. »—German Matosas, directeur de l’architecture et de la plateforme cloud, BCI

Un autre exemple est celui de Volkswagen Financial Services, une filiale de VW, qui gère environ 80 applications web dans dix pays, soit un service informatique complexe à tous égards. Confrontés à la nécessité de moderniser leurs applications et leur approche du développement, ils ont utilisé Azure Stack Hub pour apporter la vitesse et l’échelle du cloud à leurs pratiques de DevOps. Cette stratégie leur a également permis de maintenir sur place des composants de leurs applications hautement personnalisées (telles que des bases de données centrales et des systèmes SAP), en réponse aux impératifs de confidentialité et de conformité. Cela leur a également permis d’ajouter de nouveaux services sans avoir à remanier leurs applications existantes.

Qu’en est-il du cloud complet ou unique ?

Bien que ce billet se concentre sur les stratégies hybrides et multicloud, il est également utile d’évoquer brièvement l’intérêt d’un partenariat avec un seul fournisseur de cloud pour fournir des solutions de bout en bout. Cette stratégie est appelée « cloud complet » ou « cloud unique » et sert l’objectif à long terme d’arrêter tous les centres de données locaux et de déplacer toutes les charges de travail vers un seul fournisseur de cloud. Elle a également ses mérites et peut offrir des avantages par rapport à des solutions hybrides et multicloud, tels que la simplification de la gestion, la réduction de la complexité et la diminution du coût total de possession (CTP). Un partenariat avec un fournisseur de solutions cloud très résilient, tel que Microsoft, pour une stratégie de « cloud complet », a été la solution choisie par plusieurs institutions financières. Les avantages uniques d’une stratégie de « cloud complet » doivent être mis en balance avec les inconvénients potentiels mais, en principe, cette approche est autorisée par les régulateurs dans la plupart des juridictions mondiales.

Choix d’une stratégie hybride ou multicloud

De nombreuses organisations partent d’une ligne de base entièrement locale. Nous avons constaté que, quand elles commencent à consommer des services de cloud public, elles se posent des questions quant à la stratégie de déploiement la plus appropriée. Faut-il adopter une approche de cloud complet, de cloud hybride ou multicloud ?

Si vous répondez positivement à une ou plusieurs des questions ci-dessous, vous êtes probablement en bonne position pour adopter des stratégies hybrides ou multicloud :

- La stratégie numérique de votre organisation lui permet-elle d’adopter facilement des technologies nouvelles et émergentes et de les déployer dans des applications locales ou héritées ?

- Votre organisation dispose-t-elle d’une stratégie numérique qui accueille l’innovation, mais n’est pas prête à s’engager pleinement dans un cloud public ?

- Trouvez-vous difficile de répondre aux demandes de capacité de votre infrastructure informatique et de faire face à des pics de demande inattendus ou de maintenir certains niveaux de performance ?

- Votre service informatique éprouve-t-il des difficultés à gérer diverses technologies de différents fournisseurs et à garder une vue d’ensemble de plusieurs environnements ?

- Votre organisation subit-elle des pressions de la part de régulateurs ou de départements chargés de la gestion des risques pour maintenir certains processus sur place, ou dans des régions géographiques spécifiques (résidence des données) ?

- Votre organisation envisage-t-elle de se développer dans de nouvelles zones géographiques ou sur de nouveaux marchés ?

Pour plus d’informations, explorez les ressources suivantes

- Potentialisation des stratégies hybrides des clients grâce à l’innovation de Microsoft.

- Préparez-vous à ce qui suit : Migration cloud accélérée.

- Planification de sortie.

- Risque de concentration : perspectives de Microsoft.

- En savoir plus sur les solutions de cloud hybride Azure.

- Pour en savoir plus sur le portefeuille Azure Hybrid, téléchargez le livre électronique hybride & Multicloud : Cloud Anywhere : Azure pour les environnements hybrides et multiclouds.