Bank-grade security, super-fast transactions, and analytics

If you live in Asia or have ever traveled there, you’ve probably witnessed the dramatic impact that mobile technology has had on all aspects of day to day life. In Hong Kong in particular, most consumers now use a smart phone daily, presenting new opportunities for organizations to deliver content and services directly to their mobile devices.

As one of the world’s largest international banks, HSBC is building new services on the cloud to enable them to organize their data more efficiently, analyze it to understand their customers better, and make more core customer journeys and features available on mobile first.

HSBC’s retail and business banking teams in Hong Kong have combined the convenience afforded by smart phones with cloud services to allow “cashless” transactions where people can use their smart phone to perform payments digitally. Today, over one and a half million people use HSBC’s PayMe app to exchange money with people in their personal network for free. And businesses are using HSBC’s new PayMe for Business app, built natively on Azure, to collect payments instantly, with 98 percent of all transactions completed in 500 milliseconds or less. Additionally, the businesses can leverage powerful built-in intelligence on the app to improve their sales and operations.

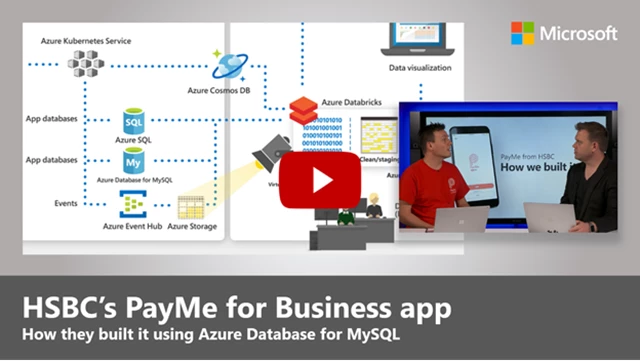

On today’s Microsoft Mechanics episode of “How We Built it,” Alessio Basso, Chief Architect of PayMe from HSBC, explains the approach they took and why.

Bank-grade security, faster time to delivery, dynamic scale and resiliency

The first decision Alessio and team made was to use fully managed services to allow them to go from ideation to a fully operational service in just a few months. Critical to their approach was adopting a microservices-based architecture with Azure Kubernetes Service and Azure Database for MySQL.

They designed each microservice to be independent, with their own instance of Azure managed services, including Azure Database for MySQL, Azure Event Hub, Azure Storage, Azure Key Vault for credentials and secrets management, and more. They architected for this level of isolation to strengthen security and overall application uptime, as shared dependencies are eliminated.

Each microservice can rapidly scale compute and database resources elastically and independently, based on demand. What’s more, Azure Database for MySQL, allows for the creation of read replicas to offload read-only and analytical queries without impacting payment transaction response times.

Also, from a security perspective, because each microservice runs within its own subnet inside of Azure Virtual Network, the team is able to isolate network and communications back and forth between Azure resources with service principals via Virtual Network service endpoints.

Fast and responsive analytics platform

At its core, HSBC’s PayMe is a social app that allows consumers to establish their personal networks, while facilitating the interactions and transactions with the people in their circle and business entities. In order to create more value for both businesses and consumers, Azure Cosmos DB is used for graph data modelled to store customer-merchant-transaction relationships.

Massive amounts of structured and unstructured data from Azure Database for MySQL, Event Hubs, and Storage are streamed and transformed. The team designed an internally developed data ingestion process, feeding an analytical model called S.L.I.M (simple, lightly, integrated model), optimized for analytics queries performance, as well as making data virtually available to the analytics platform, using Azure Databricks Delta’s unmanaged table capability.

Then machine learning within their analytics platform built on Azure Databricks allows for the quick determination of patterns and relationships, as well as for the detection of anomalous activity.

With Azure, organizations can immediately take advantage of new opportunities to deliver content and services directly to mobile devices, including a next-level digital payment platform.

- To learn more about how HSBC architected their cashless digital transaction platform, please watch the full episode.

- Learn more about achieving microservice independence with your own instance of a Azure managed service like Azure Database for MySQL.